During this era of social distancing and confinement, anyone who has been purchasing groceries online has experienced the challenges with delivery of these products. These challenges can be attributed to constraints relating to warehousing, logistics, and supply chain issues which have been revealed as the novel COVID-19 ravages the planet.

Previously, the growth of e-commerce has been somewhat restrained, as some consumers object to online shopping and in particular, a reluctance to shop for groceries online. However, the government imposed stay at home measures have created a surge in e-commerce. Consider that on March 13th and 15th the U.S. grocery industry had a 100% increase in daily online sales compared to the baseline period of March 1 – 11.* This is expected to be sticky as consumers more widely adopt these practices, trust, and enjoy shopping online. A “Brick meets Click/Shopper Kit” survey found that 46% of respondents will continue to purchase goods online post pandemic.* This will increase the demand for cold storage space. CBRE Research has found that an additional 75M to 100M of freezer/cooler space will be needed to meet the demand for direct to consumer food delivery. The global pandemic is now accelerating this trend.

The fact that restaurants have been forced to shut down does not change this trend. Food is shipped in and out of warehouses whether it’s delivered to restaurants, grocery stores, or direct to consumer. While restaurant revenues decrease, grocery sales rise and distributors adjust their supply chains.

The increasing demand is not for only online ordering of groceries but across the flow of the entire spectrum of e-commerce delivery of consumer goods. Industrial properties are now and will continue to be the beneficiary of this phenomenon as e-commerce continues to expand and implementation of last mile logistics continues to grow. The expectation is that along with the growth of e-commerce, inventory held on hand will also continue to expand. This will significantly impact the demand for warehouse space across the country. Consider the following data points:

- Each incremental $1B of e-commerce sales growth requires approximately 1.25M SF of warehouse space

- If e-commerce grows at an annual 20% rate over the next 5 years (vs. the projected 14%), then there will be a need for up to an additional 400M sf above the 500M sf what was projected given the actual 15% annual growth rate.

- A 5% increase in business inventories would require an additional 700M to 1B SF of occupied space.*

Current supply chains have adopted a just in time model and are designed for perfection with the objection of warehousing a minimum amount of inventory. Now, we see weakness in this model when sourcing of products is stressed to capacity (e.g. toilet paper). Moving forward the amount of inventory held will increase and thus increase the demand for warehouse space.

Another area of weakness in supply chain is sourcing of products. We now see an over reliance on products from overseas including medical equipment and instruments, pharmaceuticals, electronic components and auto parts. There will therefore be a trend for on-shoring of manufacturing to mitigate supply chain challenges.

Last, new construction of new industrial product has been muted and 50% of properties due to deliver in 2020 are either build to suit projects or pre-leased. So a sudden delivery of new industrial product is a non-issue. Further, in the Boston area, we have witnessed a drastic reduction of industrial supply as many properties close to downtown have been repositioned to higher and better uses such as multi-family, office or retail development. There is speculation that multi-story last mile logistics facilities which have emerged in New York City and Seattle will continue to be developed in metro areas.

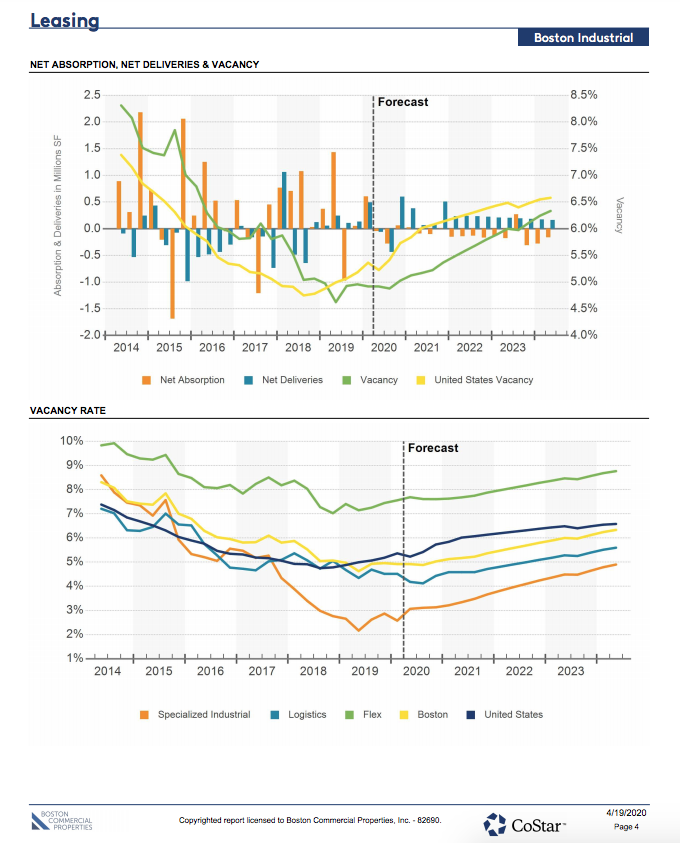

All of these factors will contribute to increasing demand for industrial space which will keep vacancy rates low, support lease rates and property values. Indeed, Costar has reported that even in a worse case scenario, vacancy rates will remain in the single digits. See charts below for a general overview of absorption and vacancy rates.

An experienced commercial real estate broker can assist with navigating this complicated landscape and be a valuable resource and help guide through the market.

Warren Brown, Boston Commercial Properties, Inc.

*Source: CBRE research